Microgaming Mobile Casinos that Accept eCheck

Remember the feelings after having won some cash at a beloved online casino from Microgaming? Definitely, you do. That is a moment which is difficult to forget.

One more question – remember the minute when choosing a payment method to draw out all your gainings? Was it ok? No problems? Using eCheck, the answers will be sure as hell.

You should be informed that Microgaming has gathered a great popularity among the representatives of the target audience. The bigger part of the gamblers prefers spending time namely with the games from this very soft provider.

One more reason for that is a large selection of banking options, where e-bills take pride of place. Here is a guide for you to check out all necessary information.

eCheck – Digital Banking Check

Being a novice in the field of Internet finance processing, you should get acquainted with eCheck possibilities. Too excited about that? Easy, tiger! Be ready to use drafts of electronic type – equivalents of the usual ones, but available on the web.

In the year of 2016, those cheques have become more widely utilized by the players who gamble and risk than the real ones. They operate in parallel with such famous methods as PayPal, Neteller, Skrill, EcoCard and others.

Payment Process

Even a kid can manage it – the process is as simple as twice two makes four. The procedure usually consists of 4 steps: authorizing in a program, entering data of the transaction, processing and the confirmation or verification.

Authorizing includes the thrill-seekers being informed that their real bills will be worked up (here you need to permit this action by means of telephone or e-mail).

Transaction details include information about bank routing and account numbers and the name associated with an account. It is entered only ONCE – so be careful filling those lines.

The 3d step implies elaboration by ACH (automated clearing house) of everything you have already mentioned – your data. And the last step makes the payment visible and accessible to the user.

Do not forget about the fees. They are not percent-bearing. In most cases, you will have to pay from 25 cents to $1.5 for a single electronic cheque. A fee on a credit card may compose 2.9% – and it is really more than for an eCheck.

eCheck Technology

The technology of this payment method is based on two notions – Financial Service Markup Language and digital signatures. Let’s, first of all, consider FSML. All hazardous Microgaming fans should be aware of those definitions.

It is somehow similar to HTML – it applies special tags in order to pattern different notifications and create big blocks and information cells. This language is developed in such a manner, that it makes it possible to entirely work up a document.

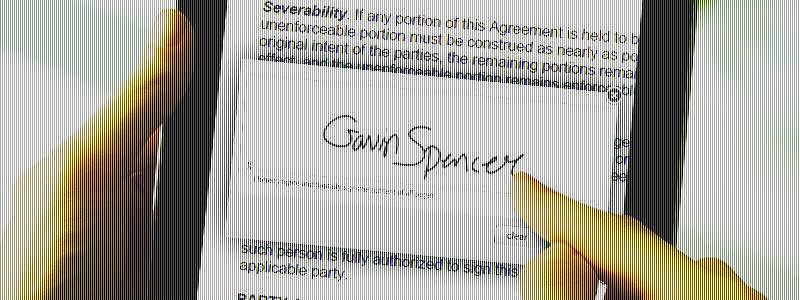

The next basic technological innovation is a digital signature. At the first blush, it seems illogical and simply impossible. However, it is implemented and frequently used by online casino lovers.

Mathematical calculations allow to identify the individual who has signed a document. With its help, it has become conceivable to determine not only a man, but also a company which the document belongs to.

Advantages

Electronic cheques include an equal information as usual paper ones. So do not be afraid that something can be missed. It is legal to use them – so no troubles with the law will bother you.

It is easy to exchange data between different parties – for example, the gambler and the institution. Distant transactions are now the things of reality due to those Internet drafts. There are almost no odds to encounter a fraudster – everything is thoroughly inspected.

Secure hardware and digital certification rank the system at the top. Apart from that, it is not difficult to complete the fields – no misunderstandings can appear. The most essential thing is that the fees here are lower than any other payment systems require.

Disadvantages

Having discussed all the advantages, it is difficult to switch to the negative sides of the issue. Why is it hard? Because there not so many downsides in this case.

The procedure of reimbursement confirmation can take some time – for someone it is very irritating. Can that be a con? You have to decide as there are both patient and snorty high rollers who have various attitudes to the waiting process. Nevertheless, how long it takes, the bigger importance is placed on the safety – and that is offered.

How Do eChecks Compare to Paper Checks

Eager to find the differences between electronic checks and paper ones? Do not want to disappoint you. No matter what. FSTC designed eCheques can operate as complete prototypes of true banking bills. Each operation that you arrange with real drafts are fully possible with their web analogues.

Digital variants are more convenient and their formation is faster. Conservatives and older players of Microgaming games usually opt conventional banking methods. There is no limitation to use one exact version – choose what you prefer.